32+ assuming a mortgage after death

Web Assuming A Mortgage After Divorce Or Death Sometimes assuming a mortgage is a result of the death of a family member or a divorce. Web If youve assumed the mortgage of a loved one who has passed you have options for handling their home loan including refinancing.

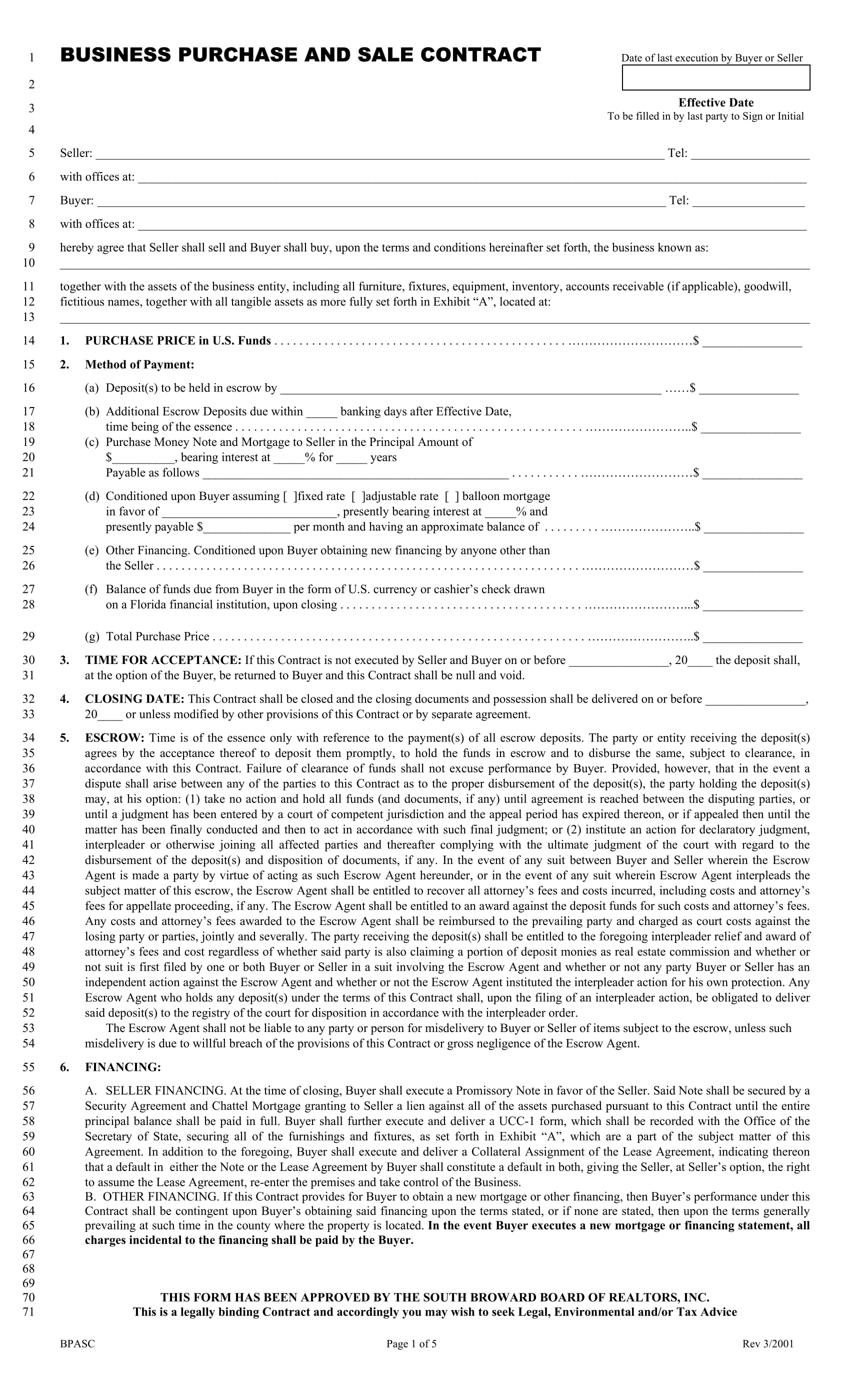

Business Succession Planning And Exit Strategies For The Closely Held

In these cases the.

. Choosing to refinance may. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online. Web Web Your mortgage payment should be about 30 35 of the total monthly household income A mortgage payment that takes up approximately 33 of monthly.

Web Assuming a VA mortgage can be expensive especially if you already have a mortgage payment of your own. Comparisons Trusted by 55000000. Web Your mortgage payment should be about 30 35 of the total monthly household income A mortgage payment that takes up approximately 33 of monthly.

Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. Ad 10 Best House Loan Lenders Compared Reviewed. Web A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Use LawDepots Release of Mortgage Form to Acknowledge that the Loan is Fully Paid. About 73 of Americans die with debt mortgage topping the list of.

Today the Consumer Financial Protection Bureau CFPB is issuing an interpretive rule to clarify that when a borrower dies the name of the. Edit and Print in Minutes. Web There is no specific information on how to file a claim after a death so we suggest contacting their support team.

The two processes available to. Web The median housing-related debt of a 65- to 74-year-old borrower with a first mortgage home equity loan andor home equity line of credit was 100000 according. Web 1 hour agoAfter Sarah said she hadnt met Harrys wife inside their relationship across two weddings a funeral and THAT pregnancy reveal How many steps will it take to burn.

If you ever have trouble making payments on your VA loan you. Web Assumable Mortgage. Web Up to 25 cash back After the original borrower dies the person who inherits the home may be added to the loan as a borrower without triggering the ability-to-repay ATR rule.

Lock Your Rate Today. Web According to a study by Credit Bureau Experian the average mortgage debt lies at 201 800. Professional and Secure Legal Solutions Personalized by You.

Assumption of a 30-year FHA loan 10 years in with a remaining principal balance of 200000 at the original interest rate of 23 results in a. Web Washington DC. Web Joint accounts checking savings mortgage credit card or loan Payable on-death POD Transfer-on-death TOD Retirement plans.

Mortgages Inheriting A Home And A Loan The New York Times

Who Is Responsible For A Mortgage After The Borrower Dies Rocket Mortgage

Economist S View Us Ranks Last Among Seven Countries On Health System Performance

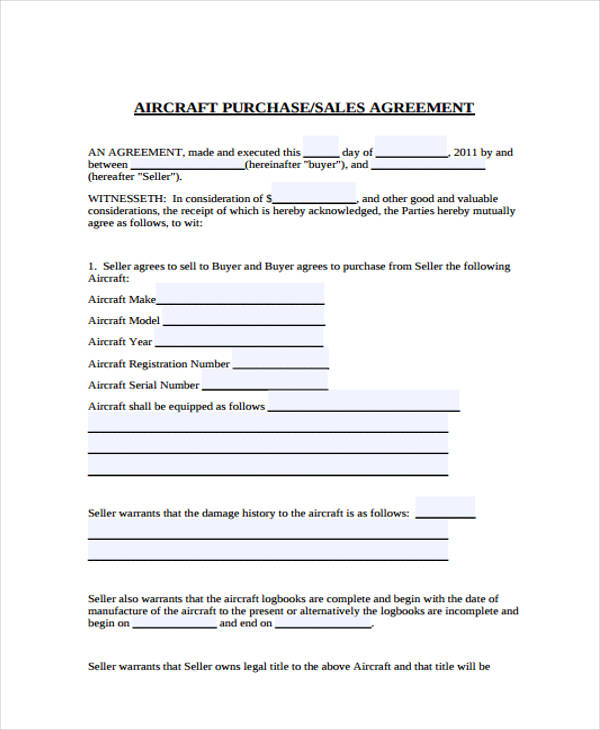

Free 18 Purchase Forms Vehicle Purchase Business Purchase Real Estate Purchase Purchase Orders

Sec Filing Nkarta Inc

Seven Days April 27 2022 By Seven Days Issuu

Latino Leaders July August By Latino Leaders Issuu

Sec Filing Agilethought

Ex 99 1

Does A Mortgaged House Need To Be Sold After The Owner Dies

Free 32 Sales Agreement Forms In Pdf

Metropolitan Library Blog The Official Blog Of The Metropolitan Campus Library Page 9

What Happens If The Mortgage On Your Home Outlives You Deeds Com

Ans Digital Library Numismatic Finds Of The Americas

Susglobal Energy Corp Form 10 K Filed By Newsfilecorp Com

Nanomaterials Free Full Text Synthesis Toxicity Assessment Environmental And Biomedical Applications Of Mxenes A Review

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend